by Jennifer | Feb 15, 2022 | Tips & Tricks

We’ve just made it through another Valentine’s Day! This is one of those holidays that people have mixed feelings about. Is it a “Hallmark Holiday” that’s just derived to bolster certain parts of our economy as we see everything romance and dining marked up to...

by Jennifer | Jan 29, 2022 | Business-Planning, Retirement-Planning, Tips & Tricks

The pandemic has challenged small business owners in far too many ways. It’s not easy for many employees to juggle family responsibility, cash flow strain, job uncertainty, and more on top of the health concerns that come with a pandemic. We’re seeing more...

by Jennifer | Jan 23, 2022 | In-The-News, Investing, Tips & Tricks

While there has always been an effective case for investing and having your money work for you to grow your wealth, when we see inflation rising and overall positive market performance, it makes even more sense. It was reported that the Consumer Price Index (which is...

by Jennifer | Jan 10, 2022 | Insurance

Most who are reasonably healthy are thankful for that. There are even several famous quotes such as “your health is your wealth” that speak to the value of having good health. But what if your health became compromised? What impact does that...

by Jennifer | Jan 1, 2022 | Tips & Tricks

Happy New Year! As we enter 2022, January often serves as a time to reflect on the year behind us, and set goals for the year ahead. I hit the blog this time last year to talk about setting goals and creating plans to crush them, but what if that’s not enough?...

by Jennifer | Sep 27, 2021 | Business-Planning, Insurance

As we round out the month of September, Life Insurance Awareness Month, we’ve looked at the basic questions you need to ask yourself to determine if you need life insurance and how much. Of course, talking to a professional can help you get the correct...

by Jennifer | Sep 19, 2021 | Estate-Planning, Insurance, Tips & Tricks

Life Insurance. Like your automobile and home insurance, it’s to cover financial losses in the event of the unexpected. Unlike automobile and home insurance, you’ll never see the benefit of the coverage you pay for. Life insurance is not for you....

by Jennifer | Jul 17, 2021 | Tips & Tricks

Now that more activities and businesses are opening with less restrictions, you may feel the urge to get out and just DO STUFF… either on your own, with friends, or family. While it’s recommended that you check in with each business or attraction prior to...

by Jennifer | Jun 1, 2021 | In-The-News

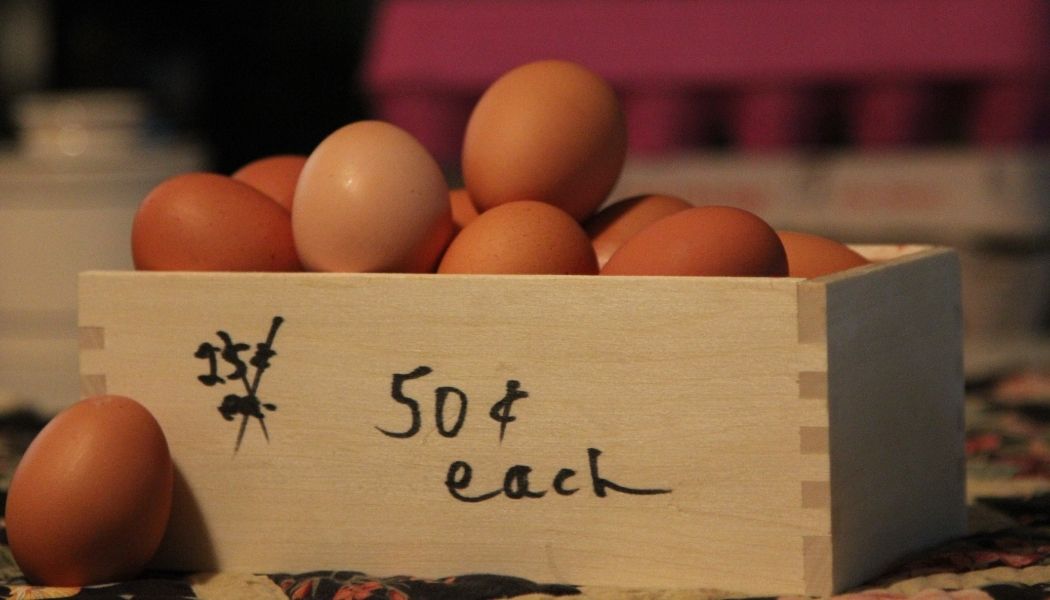

Inflation, for many, can be an invisible economic culprit affecting our bank accounts without us even realizing it. Inflation: the general increase in prices and fall in the purchasing value of money While inflation in economic terms is defined simply above,...

by Jennifer | May 1, 2021 | Investing, Retirement-Planning, Tax-Planning

If I had a dollar for every time I’ve said that tax planning shouldn’t just come in April when it’s time to submit our income taxes. It’s a practice that should be ongoing and especially reviewed once you’ve filed your previous...